unfiled tax returns for deceased

The surviving spouse or representative will indicate that the person has passed. The personal representative of an estate is an executor administrator or anyone else in charge of the decedents property.

Filing Taxes For A Deceased Person Bankrate

Over 27 years of IRS tax relief.

. You may need to file IRS Form 4506-T. You should probably sit down with an accountant or tax. She had the mistaken belief that one.

For the 2021 tax year the federal estate tax exemption was 1170 million and in the 2022 tax year its 1206 million. Request for Transcript of Tax Return to obtain tax records of the deceased person. Unfiled tax return for deceased mother Another questions is was she required to file tax returns.

Form 1040 W-2s for withheld income and 1099s. The final tax return for a deceased person is filed by their surviving spouse or legal representative. If you dont file taxes for the decedent and the estate promptly the IRS can file a federal tax lien requiring you pay the decedents income tax ahead of other bills.

Statute of Limitations for Collections and Audits. Not all income is taxable. That means filing both state and federal taxes for the year of death.

If a deceased person owes taxes in any years prior to his or her death the IRS may pursue the collection of these taxes from the. After my mothers recent death it was discovered she had not filed a personal income tax return for 10 years. What Happens To Unpaid Taxes After Death Community Tax The deadline to file these returns is the normal filing deadline of April 30.

If you have IRS tax problems because of unfiled tax returns Top Tax Defenders can help you. Irs form 1310 if the deceased will receive a refund this. Unfiled tax return for deceased mother.

Had essentially no estate except cash. Unfiled Returns on deceased parent 1 Answers Ok heres a complex one. In most cases the estate representative will need to file an IRS Form 1040.

When filing taxes for a deceased. The decedents income will count from January 1 of the year they passed until the day. Top Tax Defenders boasts experience and expertise including.

Unfiled tax return for deceased mother. Form 1040 W-2s for withheld income and 1099s for untaxed income may be needed. Father in law died early this year from long about with cancer.

How To Handle Business Taxes For The Deceased France Law Firm

Blog Archives Page 2 Of 35 My Irsteam

What Happens If A Deceased Person Owes Taxes Tax Group Center

Complete List Of Irs Notices Boxelder Consulting

Filing A Paper Return Ask These Questions

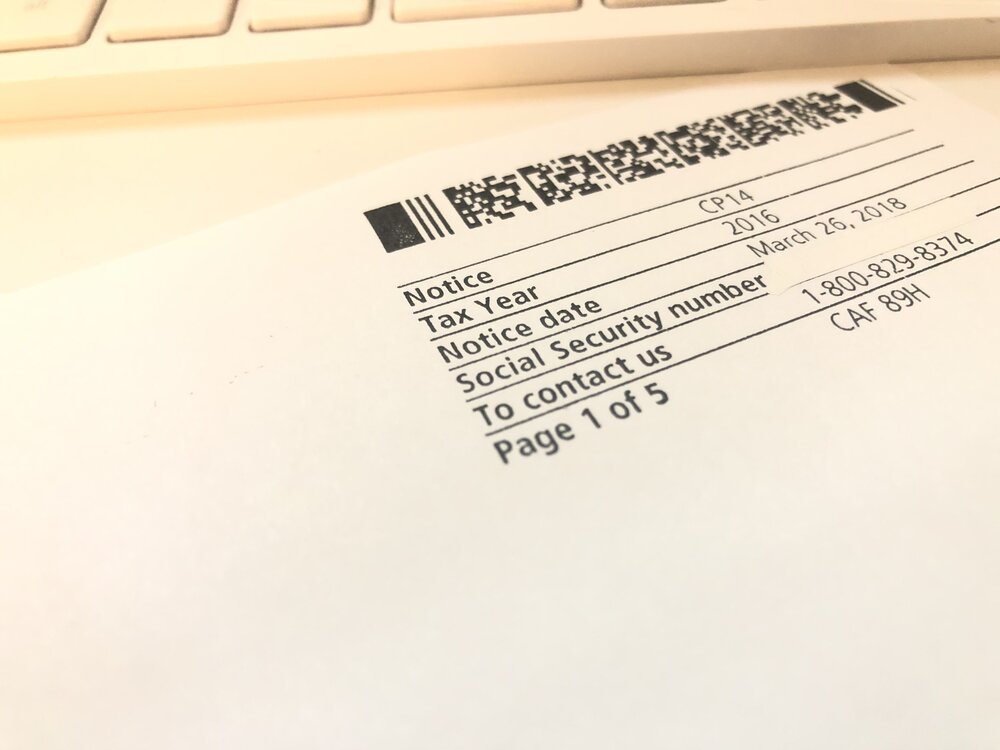

Why Did I Receive An Irs Cp14 Notice In The Mail Your Guide What To Do With The Irs Cp14 Letter Get Rid Of Tax Problems Stop Irs Collections

File Old Tax Returns Wilson Rogers Company

What Happens If Self Employed Don T File A Tax Return Mileiq

Estate Tax Returns Estate Planning Estate Settlement The American College Of Trust And Estate Counsel

Filing A Paper Return Ask These Questions

Tax Season 2022 It S Going To Another Hectic Year The Washington Post

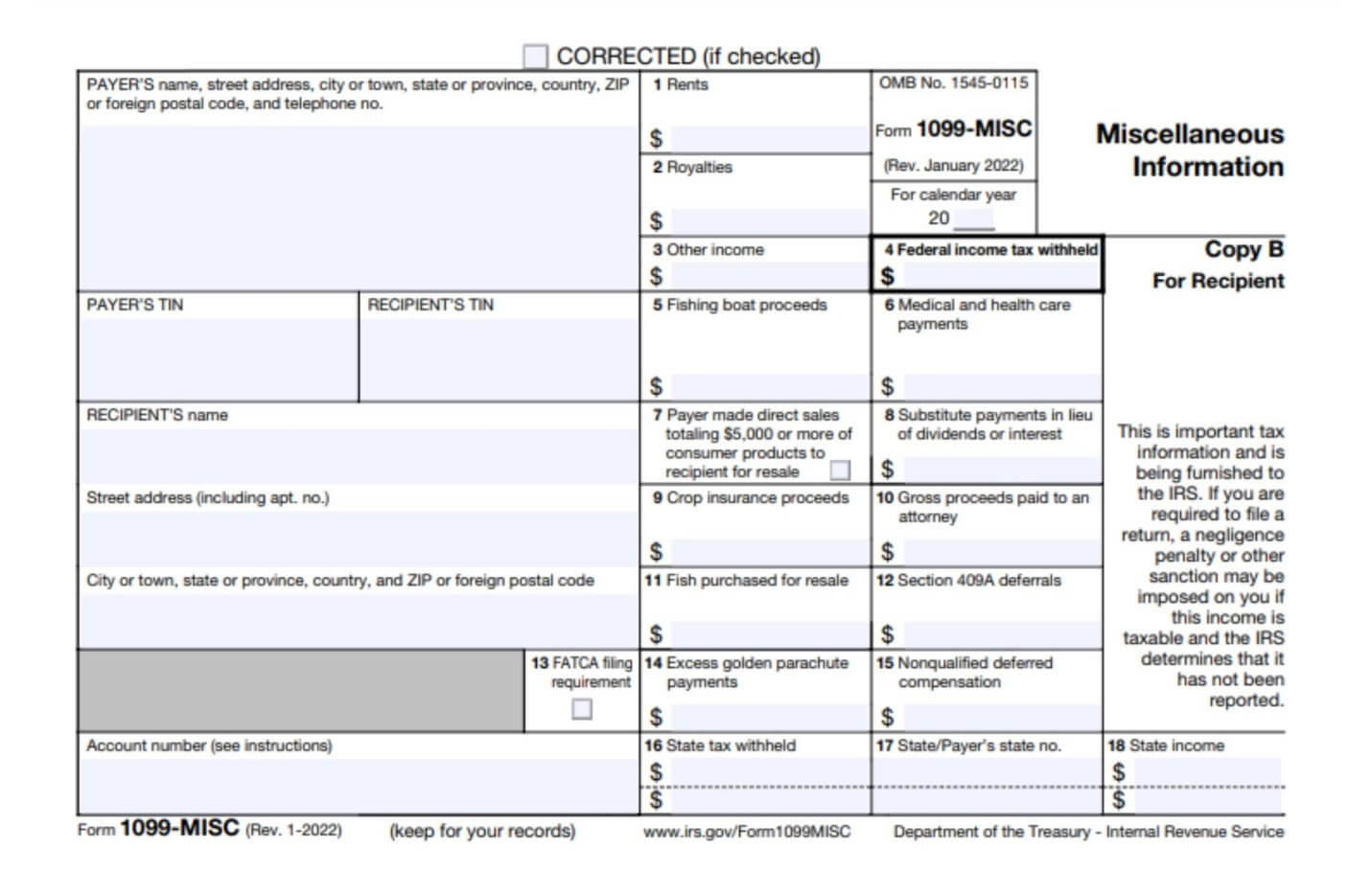

Understanding Irs Form 1099 Misc

The Ultimate Guide To Unfiled Tax Returns Save Time Money And Stress

Do I Need To File A Tax Return On Behalf Of The Deceased And The Estate Brian Douglas Law

Some Tax Refunds May Be Delayed This Year Here S Why Cbs News